🍵Anti-Dilution

Function and Usage

Members and attributes

Price Benchmark Objects

Meaning of Price Benchmark Object Attributes

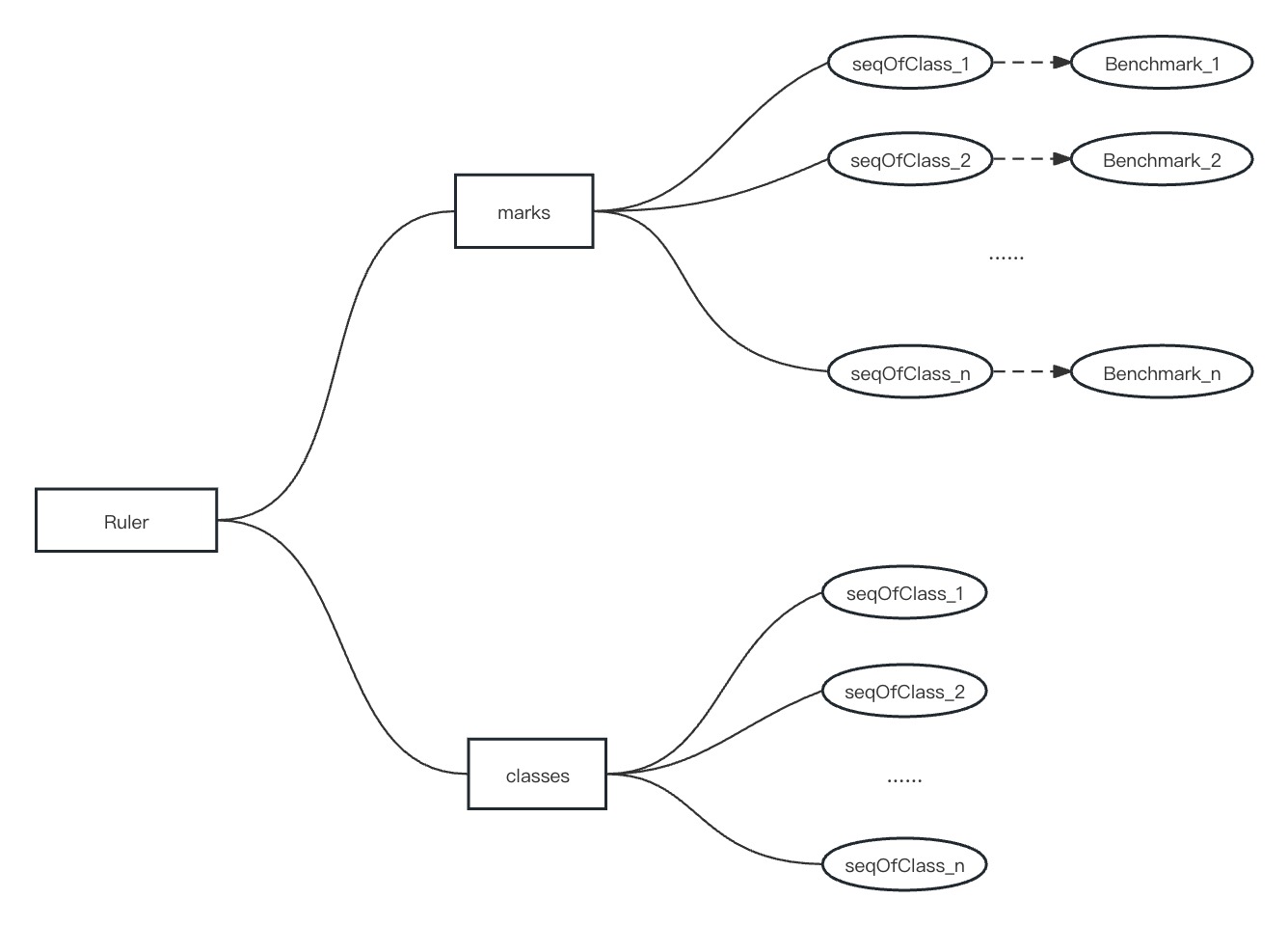

Price ruler objects

Meaning of Price Ruler Object Attributes

Query API

Source Code

Last updated