⚖️Option and OptionsRepo

Functions and Usages

The Options Repo is a public library that defines the option objects and their operation methods for adding, deleting, changing, and checking.

The Options refers to Compulsory Purchase Options and Compulsory Sell Options defined through the Options Terms of the Shareholders Agreement, which are automatically installed in the Register of Options after the Shareholders Agreement is activated by passing in the General Meeting. The right holder can trigger the exercise of rights after the triggering conditions are fulfilled.

The trigger conditions may include the time factors such as the rights exercise period, and also include off-chain data (up to three sets) through condition objects. Therefore, parties may consider external data such as business income, net profit as the triggering conditions for Compulsory Purchase Options and Compulsory Sell Options, so as to realize special investor rights and interests such as "valuation adjustment" or "right of first refusal clearance".

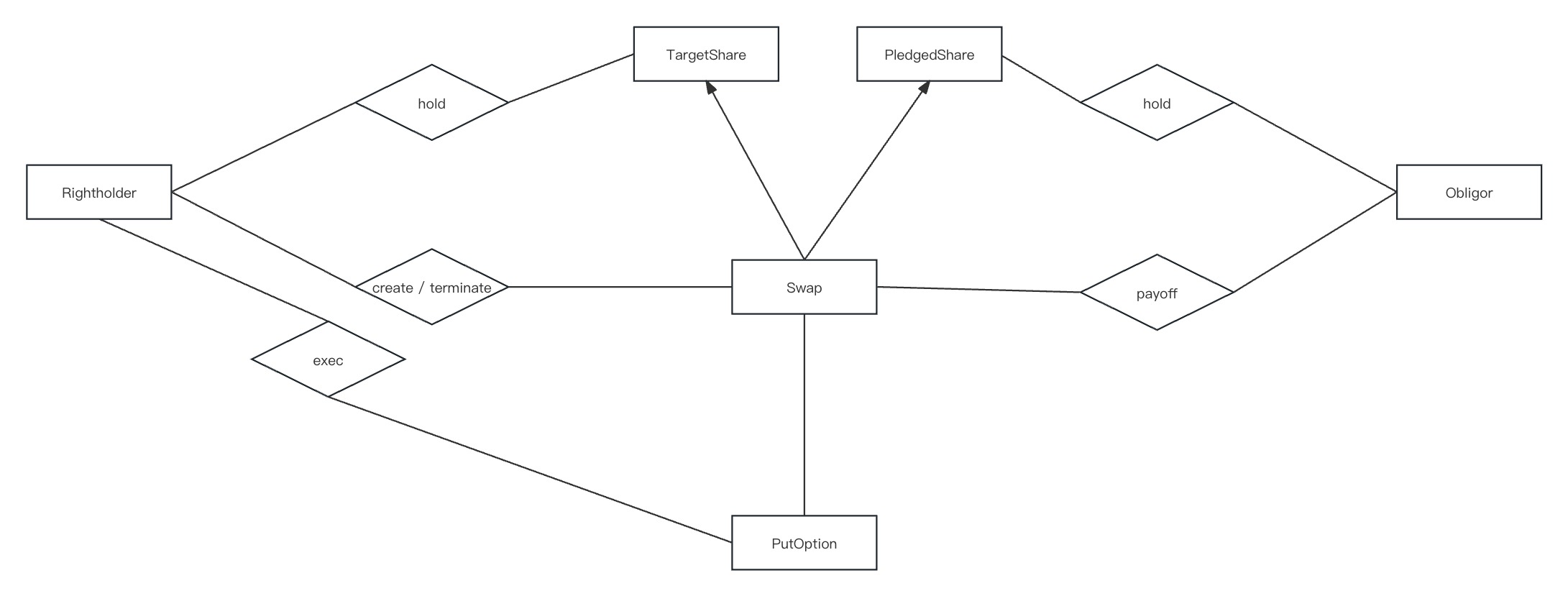

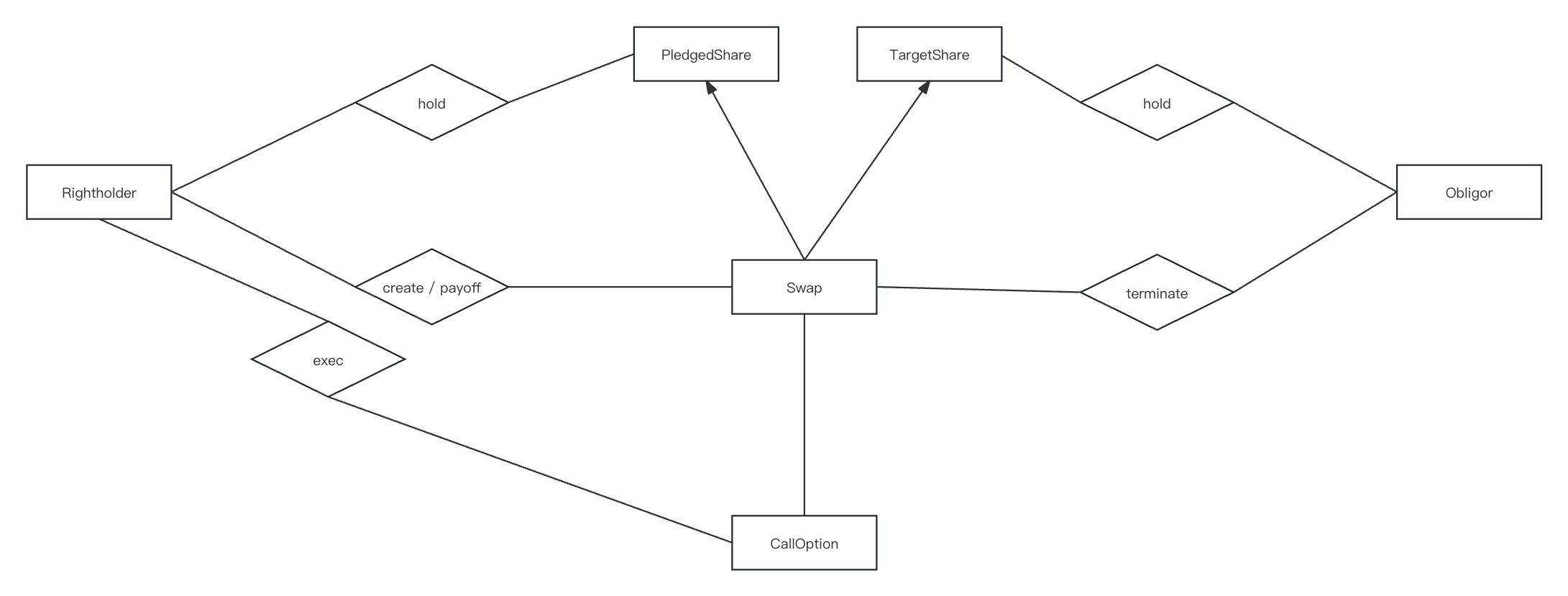

The system adopts the creation and execution of Swap Contracts to fulfill Compulsory Purchase Options and Compulsory Sell Options.

Specifically, when the Compulsory Sell Options is exercised, the right holder may select specific shares held by the obligor as "Pledged Shares" to create a Swap Contract with its own "underlying shares". The obligor may choose to pay ETH as the compulsory purchase options price to acquire the underlying shares, otherwise, the right holder may execute the swap to acquire the pledged shares as netting (difference between the compulsory purchase options price and the underlying shares issuance price) to terminate the swap.

At the time of exercising the Compulsory Purchase Options, the right holder may select the " underlying shares" that meet the agreed category of the Option Contract held by the obligor to set up the swap, and at the same time, the system will automatically lock the underlying shares so that the right holder will not be able to transfer shares within the paid-up amount of the Option Contract. Afterwards, the right holder may choose to pay ETH as the consideration for the Underlying Shares (i.e., realizing the Compulsory Purchase Option), otherwise, once the validity period of the Swap Contract has expired, the obligor may terminate the Swap Contract in order to release the lock of the underlying Shares.

Members and Attributes

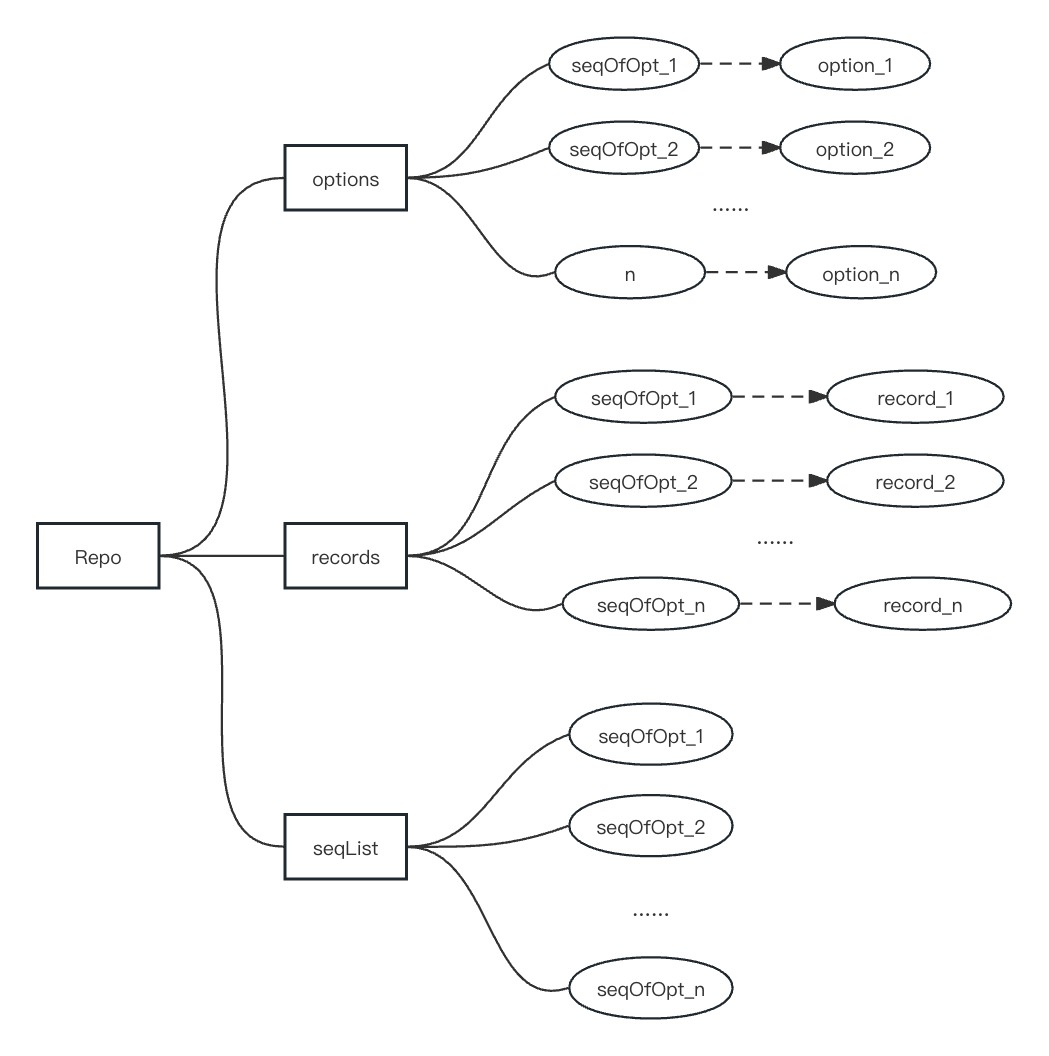

The members of the options repo include option objects and their exercise record objects, as well as an option mapping composed of the option number as the query key and an exercise record mapping and a list table of option numbers.

Condition objects

🔄Condition and ConsRepoOption Object

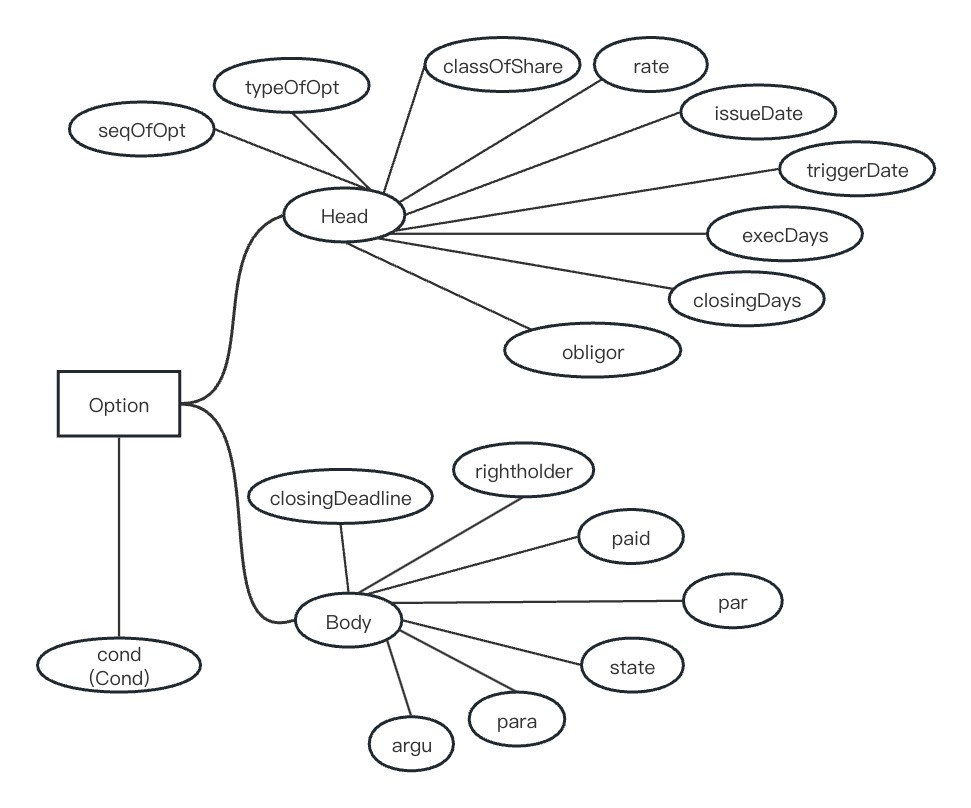

The option object includes two key attributes, Head and Body, which define all the elemental information required in the establishment and execution process of the Compulsory Purchase Options and Compulsory Sell Options, respectively. At the same time, a condition object attribute is reserved in the option object to flexibly input various types of off-chain data as option triggering conditions.

Attribute List of Option Objects

seqOfOpt

The number of option.

typeOfOpt

Option Type. 0-Price of compulsory buy option, 1-Price of compulsory sell option, 2-ROE Compulsory buy option, 3-ROE compulsory sell option, 4-Compulsory buy option with price condition, 5-compulsory sell option with price condition, 6-ROE Compulsory buy option with condition, and 7-ROE Compulsory sell option with condition.

classOfShare

Class of share.

rate

Option rate. The price at which the equity is traded (unit is cent) in the case of price options; the annualized ROE ratio (unit is "one in a ten-thousand", i.e., "basis points") in the case of ROE options.

issueDate

Option Issuance Point.

triggerDate

The point at which the exercise period begins.

execDays

The number of days in the exercise period.

closingDays

The number of days in the closing period (after exercise).

obligor

The user number of obligor.

closingDeadline

Closing deadline of delivery.

rightholder

The user number of right holders.

paid

The amount of the paid-in shares of option.

par

The amount of the subscribed shares of option.

state

The state of the option. 0-Preparing, 1-Issued, 2-Executed, 3-Delivered.

cond

Trigger conditions of the option. Defined as structured "condition Objects" that can bring triggering conditions that up to 3 sets of comparison calculations and 2 sets of boolean calculation.

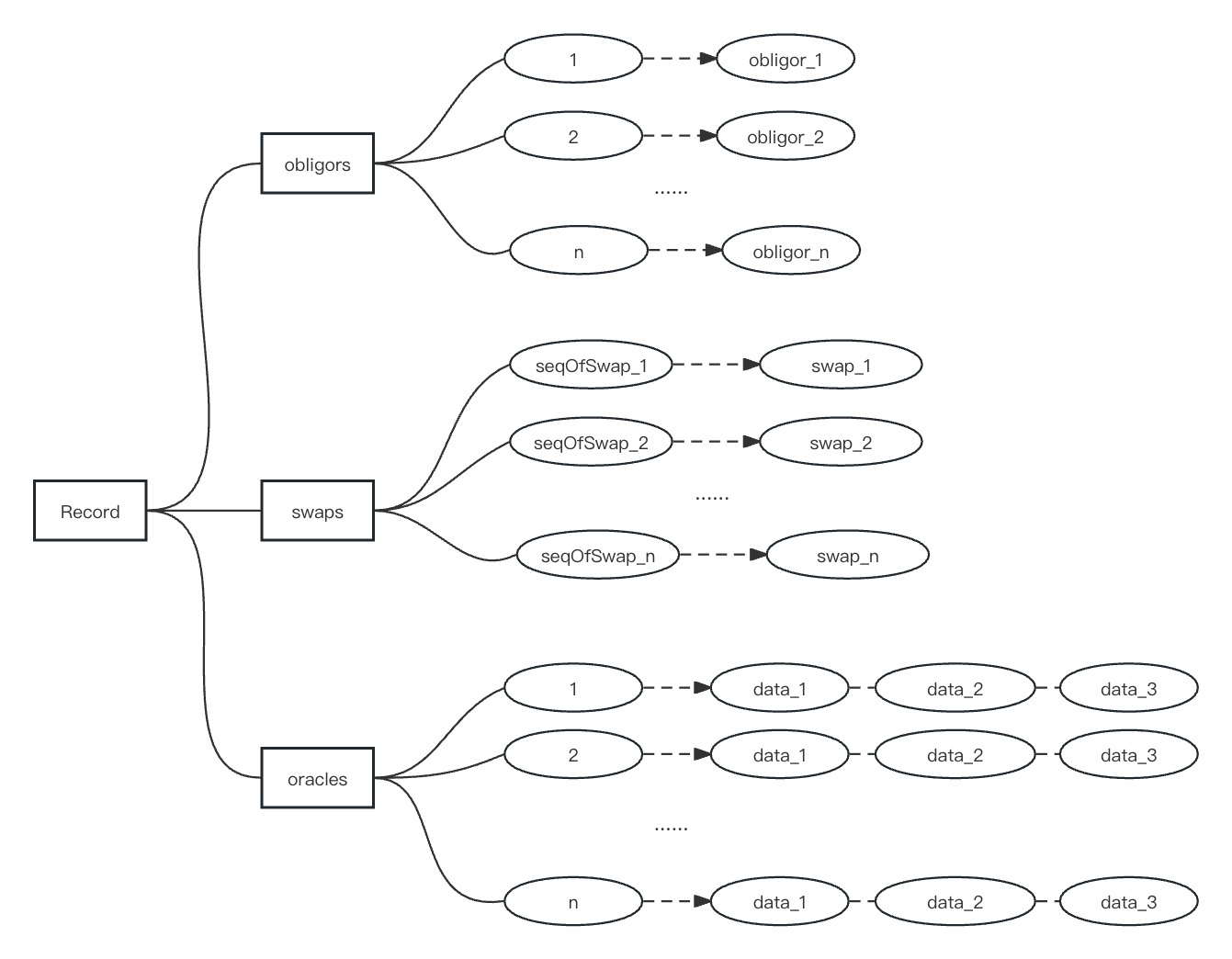

Exercise Record Object

As the name suggests, the usage of the exercise record object is to record the performance of an option, which mainly consists of the obligors set, swap repo adopting an enumerable set structure, and the external triggering data adopting a historic state sequence structure.

The Attribute List of Exercise Record Objects

obligors

The number list of obligors (enumerable sets).

swaps

Swap repo.

oracles

historic state sequence of external trigger condition data.

Options Repo

The options repo mainly consists of an options mapping and an exercise record mapping with the option number as the query key and the option object and exercise record object as the value, respectively, as well as a list of options' numbers with an enumerable set structure.

Query API

The query API well describes the function and usage of the Options repo in the whole system, as shown in the table below.

counterOfOptions

Get the current value of the option number counter.

qtyOfOptions

Get the total number of option objects.

isOption

Query whether an option object with a specific number exists.

getOption

Get the option objects of a specific number.

getAllOptions

Get the list of all option objects.

isRightholder

Query whether a user with a specific number is the right holder of an option with a specific number.

isObligor

Query whether a user with a specific number is an obligor of an option with a specific number.

getObligorsOfOption

Get a list of all obligor numbers for an option with a specific number.

getSeqList

Get a list of all the option numbers in the options repo.

counterOfSwaps

Get the current value of the Swap Contract Counter for a specific numbered option.

sumPaidOfTarget

Gets the total amount of paid-in contribution for the underlying share of all swap contracts under a specific numbered option.

isSwap

Query whether a swap contract with a specific number exists for an option with a specific number.

getSwap

Obtain the swap contract object of a specific number under a specific numbered option.

getAllSwapsOfOption

Get a list of all swap contracts under a specific numbered option.

allSwapsClosed

Query whether all the swap contracts under a specific option number have closed.

getOracleAtDate

Get the state of the external trigger data for a specific date for a specific number of options.

getLatestOracle

Get the state of the most recent external trigger condition data for an option with a specific number.

getAllOraclesOfOption

Get the historic state sequence of all external trigger condition data for a specific option number.

checkValueOfSwap

Query the value (in ETH) of a specific numbered swap under a specific numbered option at a specific fiat currency price.

Source Code

Last updated