📈Order and OrdersRepo

Function and Usage

The so-called "Listing Orders" refers to the equity transaction mechanism designed by the system to match transaction in open bidding with fixed-price delegate orders as the listing objects. The Listing Rules of the Shareholders' Agreement may authorize specific classes of shares to be issued and transferred by public bid listing. Once the reviewing and voting is passed, the relevant listing rules will come into effect, the company may list additional new shares, and the relevant shareholders may continue to list relevant class of shares after the expiration of the lock-up period.

Only investors who are verified the Real Name can buy the listed shares, and the person who can review the investor's identity information is the authorized identifier provided in the Listing Rules. The total number of investors is also set in the Listing Rules, and once the limit is reached, no new investors can be approved to join. The number of potential investors is a core element in determining "public offering" or "open market trading" in many countries, therefore the company shall determine the maximum number of investors in accordance with the relevant securities laws and regulations and commercial arrangements, and comply with the relevant reporting and disclosure requirements in accordance with the law.

Each sell order object stipulates the delegation validity period, once the validity period expires, the system will automatically withdraw of the expired sell order in the next matching. The delegates can also take the initiative to withdraw the order from the listed Gold Chain after the expiration of the validity period.

The listing shares are all transferable by listing offering, while the conditions of the offering transaction such as total offering amount, maximum offering price, minimum price, and transaction price can be stipulated in detailed Listing Rules.

The delegated sell orders will be listed in lowest to highest order from beginning to end in Gold chain. Investors can call a specific API to issue a price, issue a delegate buy order with fixed-amount and pay ETH as consideration, the system will match the orders in accordance with the "price priority, time priority" rules. In the valid delegate period, the sell order with the lowest price will be matched with the buy order, as long as the price of the sell order is less than or equal to the buy order. The amount of sold orders will be reduced accordingly, or totally removed from the Gold Chain until the buy order amount is exhausted, or until no more sell orders can be found at the right price. If there is a balance, the system will automatically return it to the investor's ETH account with the company for the investor to retrieve it on his/her own, which can prevent the re-entry attacks.

After the deal is taken off, the related sell order will be deleted directly from the Gold Chain, but the system will keep the transaction log of the successful deal.

Members and Attributes

The members of the sell orders repo include the Gold Chain composed of sell order objects, the investor mapping composed of investor objects and variable-length array, and the closing order chain and variable-length array composed of closed transaction objects. Although not a member of the sell orders repo, the listing rules of the shareholders agreement comprehensively stipulate all rules of listing offer and listing transfer.

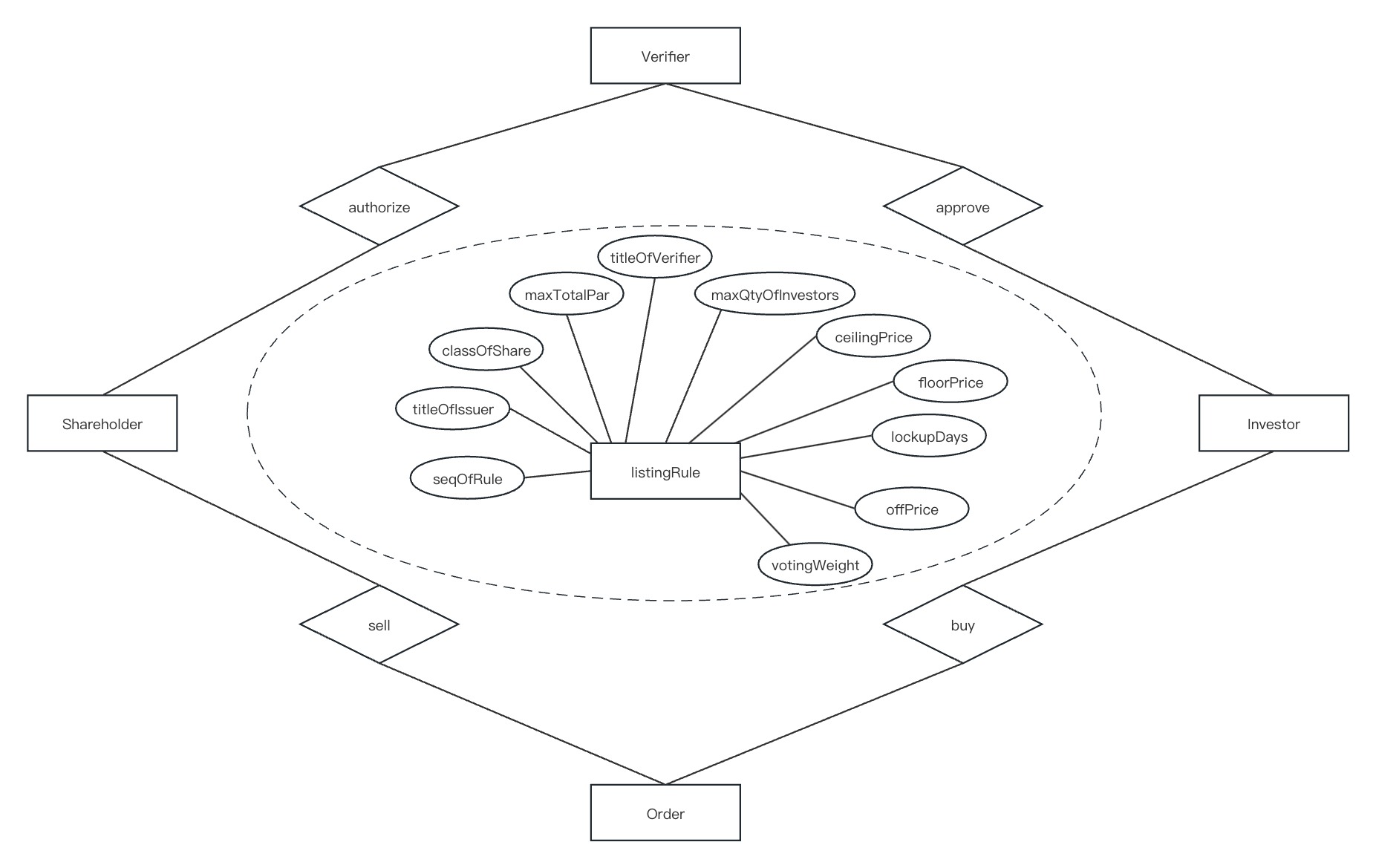

Listing Rules

Attribute List of Listing Rules

seqOfRule

The Number of rules

titleOfIssuer

(Listing offer) Title of the Issuer.

classOfShare

The number of share class.

maxTotalPar

Maximum amount of subscribed contribution (issued).

titleOfVerifier

(Investor) Title of identity verifer.

maxQtyOfInvestors

Maximum number of investors.

ceilingPrice

Maximum (issue) price.

floorPrice

Minimum (issue) Price.

lockupDays

Number of lock-up days.

offPrice

Price of close order.

votingWeight

Voting weight (of issued shares).

Sell order object and Gold Chain

🥇GoldChainDeal objects

Attribute List of Deal Objects

buyer

The user number of buyer.

groupRep

The user number of the representative of concerted actor group.

classOfShare

Number of underlying shares class.

seller

The user number of seller.

state

State

isEth

Whether the order is settled by ETH.

isOffer

Whether the order is a sell order.

paid

The amount of paid-in contribution for the close order.

price

The transaction price.

votingWeight

Voting weight of the underlying shares.

distrWeight

Distribution weight of the underlying shares.

consideration

The margin paid by buyer.

Query API

The Query API well describes the function and usage of the Sell Orders Repo in the overall system, see the table below.

isInvestor

Query whether a specific numbered user is an investor.

getInvestor

Get the investor objects for the specific numbered user.

getQtyOfInvestors

Get the total number of investor objects.

investorList

Get a list of all investor user numbers.

investorInfoList

Get the list of all investor objects.

isClass

Query whether a specific numbered share class is a listing share class.

getClassesList

Get a list of all listing share classes.

getExpired

Get the list of expired sell orders.

getDeals

Get a list of close order objects.

Source Code

Last updated